Build Your Credit

Pay your rent, watch your score climb.

33% of Users

Qualify for better credit cards within

90 days

72% of Users

See their first credit score bump

after just 2 rent payments

+28 points

Average credit score increase

reported by TenantPay users

Escape the Matrix

What Were We Thinking?

“They” said: Get into debt to build credit so you can qualify… for more debt. Genius. It’s like saying: Set yourself on fire and prove you can use a fire extinguisher — only to be asked to light an even bigger one.

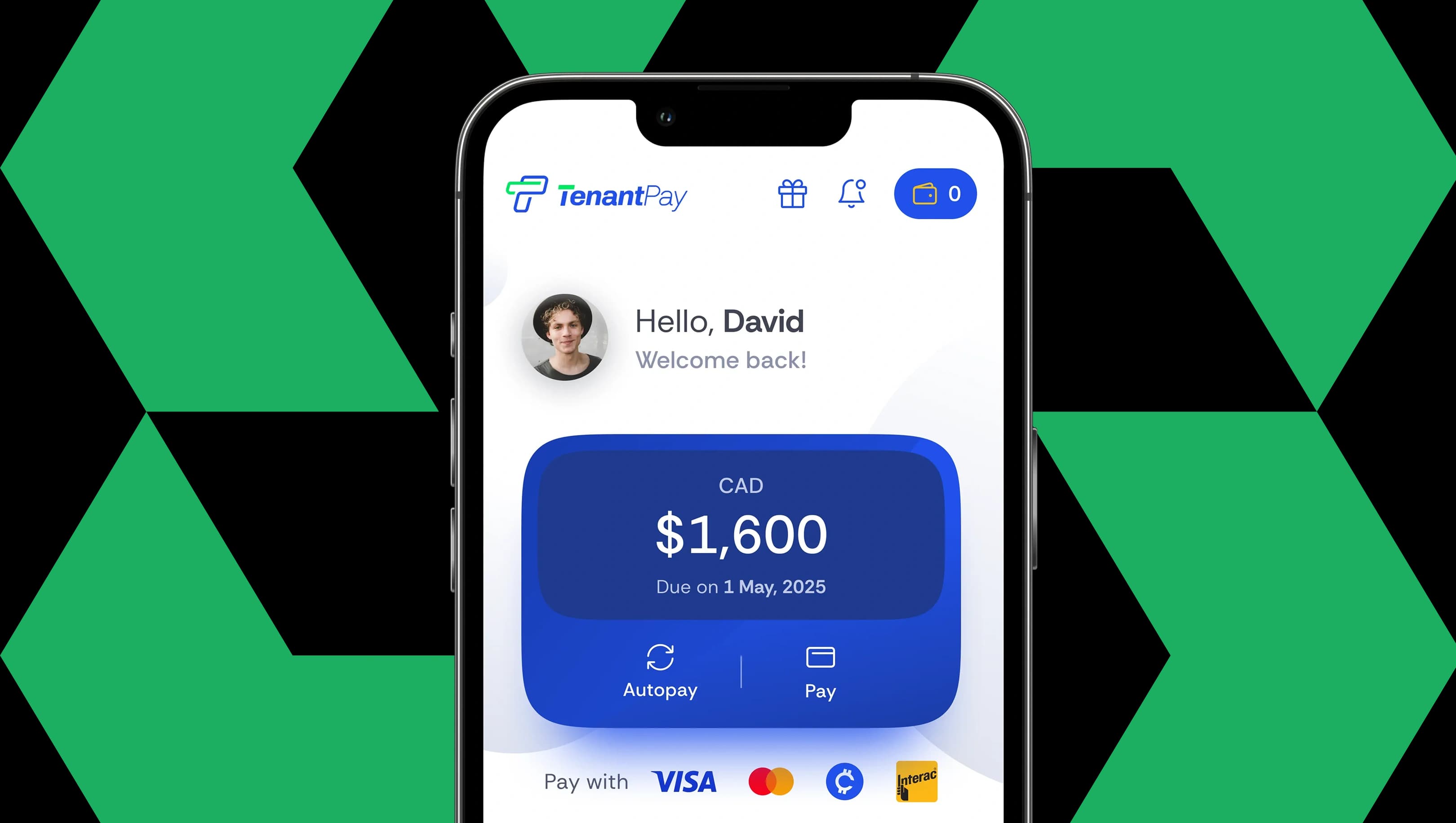

CAD

$99,743.00

6.38%

vs last month

Added Benefits, On Us

Build your credit score without borrowing a single dollar.

Check Your Score Anytime (Yep, Free)

Morning coffee? Midnight doom-scroll? Go ahead, peek at your credit score whenever. It costs $0 and 2 seconds of curiosity.

Grab Your Credit Report (Also Free)

Get the full picture of your credit life without paying a cent. It’s like snooping on yourself… legally.

in your rent story

TenantPay VS Old School

Actions that actually get you towards more points!

Comparison table between

TenantPay and old school

TenantPay

A modern, smooth way to pay your rent

Old school

Old way to pay your rent

Comparison table between TenantPay and old school

TenantPay

Modern way

Old school

Old way

Payment Reminder

Credit Card Rewards

Credit Impact

Tenant Pay Points

Receipts & Records

Payment Flexibility

Payment Methods

Landlord Involvement

Support

Transparency

Vibes

Frequently Asked Questions

Payment

Manage your payments with ease.

Rent

Get answers to rent questions.

Points

Get answers to points questions.

Build Credit

Get answers to credit questions.

Support

We’re here to help anytime.